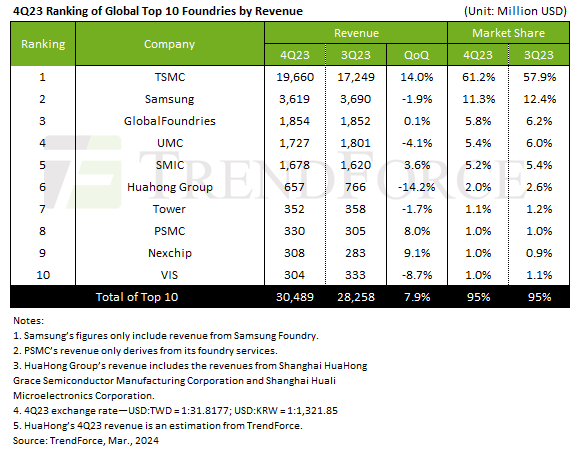

Q4 foundry revenues rose 7.9% to $30.49 billion, says TrendForce, primarily driven by demand for smartphone components, such as mid and low-end smartphone APs and peripheral PMICs.

The launch season for Apple’s latest devices also significantly contributed, fueling shipments for the A17 chipset and associated peripheral ICs, including OLED DDIs, CIS, and PMICs. TSMC’s premium 3nm process notably enhanced its revenue contribution, pushing its global market share past the 60% threshold this quarter.

Last year the foundry market suffered a 13.6% fall witnrevenue reaching $111.54 billion.

2024 promises better, says TendForce, with AI-driven demand expected to boost annual revenue by 12% to $125.24 billion.

In Q4, top 5 foundries expanded market share to 88.8% with TSMC taking 60%.

TSMC’s wafer shipments rose in 4Q23 thanks to demand from smartphones, notebooks, and AI-related HPC and its revenue jumped 14% over the quarter to $19.66 billion.

Revenue shares from processes 7nm and below climbed from 59% in Q3 to 67% in Q4, underscoring TSMC’s dependency on cutting-edge technologies. With the progressive ramp-up of 3nm production, the share of revenue from advanced processes is expected to surpass 70%.

Samsung also received orders for various new smartphone components, predominantly in mature processes above 28nm. Meanwhile, demand for advanced process main chips and modems saw steadier demand due to early procurement by clients, leading to a slight 1.9% QoQ drop in Samsung’s foundry revenue to $3.62 billion.

GlobalFoundries saw a modest 5% revenue growth in the automotive segment, primarily attributed to a surge in LTAs signed by numerous automotive clients and slight optimizations in ASP. However, shipments in key application areas such as smart mobile devices, communication, and home/industrial IoT witnessed declines, resulting in overall revenue reaching approximately $1.85 billion in Q4.

UMC experienced occasional spikes in orders from the smartphone and PC sectors, but a weak global economy, conservative wafer start decisions by clients, and inventory adjustments in the automotive sector led to a downturn in wafer shipments, resulting in a 4.1% decrease in Q4 revenue to about $1.73 billion.

SMIC enjoyed a 3.6% quarterly increase in revenue to roughly $1.68 billion, mainly due to urgent orders related to smartphones and notebooks/PCs, while shipments for network communications, general consumer electronics, and automotive/industrial control sectors saw declines.

Three significant changes occurred in rankings were, PSMC moved up to eighth place, benefiting from the recovery in specialty DRAM wafer outputs and urgent orders for smartphone components, Nexchip reentered the top ten and secured the ninth spot, thanks to urgent TDDI orders and high-volume shipments of new CIS products, and VIS dropped to tenth place due to a slowdown in TV-related orders and inventory adjustments by automotive and industrial control customers.

IFS, which entered the top ten for the first time in 3Q23, was pushed out of the rankings by PSMC and Nexchip due to factors such as the transition between new and old generations of CPUs and lackluster inventory momentum at Intel.

Other companies, such as HuaHong Group and Tower, saw their revenue decrease by 14.2% and 1.7%, respectively. The minor decline in revenue for Tower is attributed to its long-term focus on niche markets like RFFEM, automotive, and industrial control, which shielded it from the impacts felt by companies primarily in the consumer electronics sector. However, as automotive and industrial control clients also began adjusting their inventories, the utilization rate of Tower further decreased in the fourth quarter